April 07-11 2025 Edition

Air Cargo Key Trends, Q1 2025

- Air Cargo Tonnages (Global): +3% Year-on-Year (YoY)

- Average Global Rates: +4% Year-on-Year (YoY)

Comparison to Previous Period (2024):

- 2024 Average Tonnage Growth (YoY): +11%

- Q4 2024 Tonnage Growth (YoY): +8%

Factors Influencing Current Market:

- Uncertain market conditions

- Anticipated disruptive new wave of U.S. tariffs especially with China (125%)

- Removal of U.S. de minimis exemptions for shipments from China and Hong Kong

- Challenges to some long-standing supply chain models

March 2025 Performance (Month-on-Month – MoM):

- Worldwide Tonnages (MoM): +19% (March vs. February)

- Note: February figures were lower due to seasonal factory closures after Lunar New Year.

March 2025 Performance (Year-on-Year – YoY):

- Worldwide Tonnages (YoY): +5%

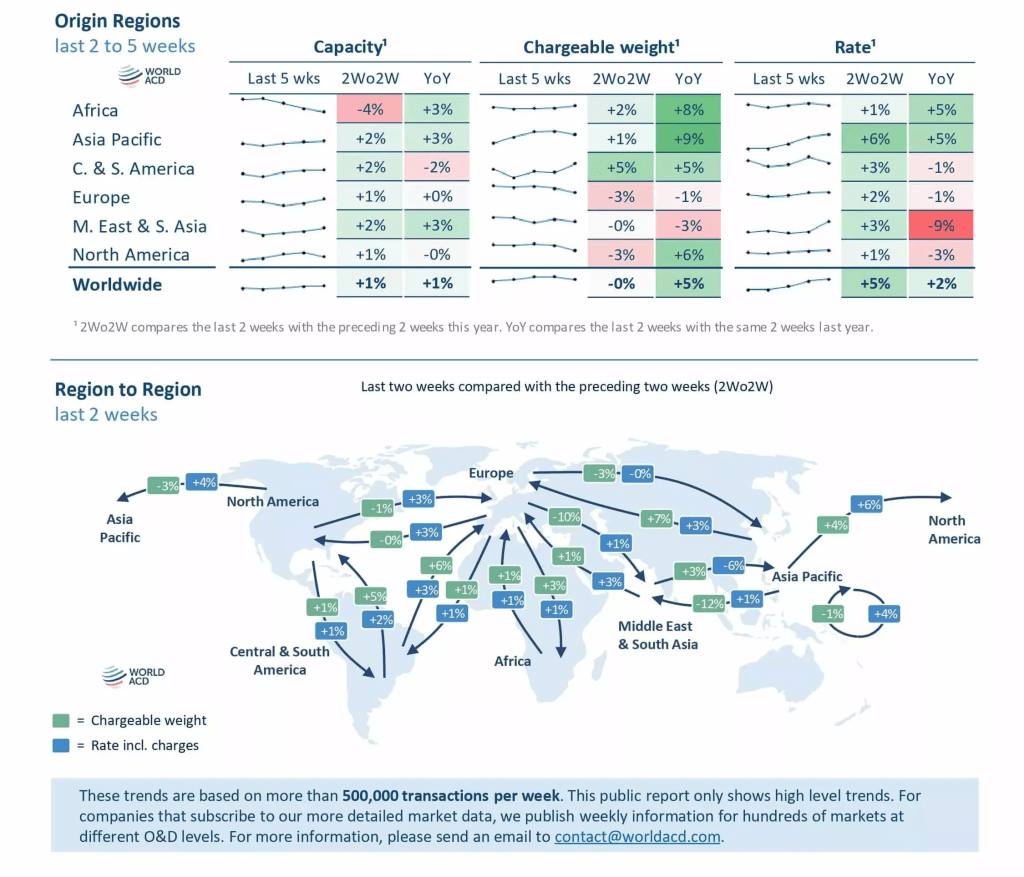

- Tonnage Growth by Region (YoY):

- Asia Pacific: +9%

- North America: +6%

- Middle East & South Asia (MESA): -6%

- Average Worldwide Rates (March): $2.38 per kilo

- Rate Change (MoM): +4%

- Rate Change (YoY): +2%

Week 13 2025 (March 24-30) – Spot Prices (Asia Pacific Origins):

- Spot Price: $3.80 per kilo

- Spot Price Change (Week-on-Week – WoW): +3%

- Tonnage Change (WoW): -3%

Shifting Trends in Global Shipping Rates

China-NA Rates Up (HKG +2.9% WoW, +3.6% YoY; SHG +2.5% WoW, +5.4% YoY): Despite some BSA cancellations, rates on busiest China-US lanes are rising. Reason: Potential volcanic disruption in Anchorage & sustained demand.

Intra-Asia (ex-China) Rates Softer: Vietnam & India routes saw slight decreases. Reason: Possible demand shift towards primary China lanes or regional economic variations.

Europe Outbound Rates Falling (FRA -14.1% WoW, still +7.3% YoY; LON -12.2% WoW, -11.2% YoY): Rates down to China, Japan, & US. Reason: Easing demand for European exports & potential market correction after prior gains.

Americas Outbound Rates Rebounding (CHI +11.1% WoW, +12.4% YoY): Rates rising again to China, Europe, & South America after recent drops. Reason: Potential strengthening demand for American exports.

Key Trend: Divergent rate movements across trade lanes. China-NA strong, Europe weakening, Americas recovering, other Asia softer. Driving Factors: Demand shifts, potential short-term disruptions (Alaska volcano), and market corrections are influencing these changes.

Viet Nam / USA Trade: Signs of Goodwill

Key Context:

- U.S. initiated 90-day “tariff pause,” impacting Vietnam.

- This pause gives Vietnam time to adjust to trade shifts.

Vietnam’s Response:

- Increased U.S. Imports:

- Buying Boeing aircraft.

- Boosting agricultural imports (soybeans, corn, pork, wheat).

- Expanding LNG imports.

- Considering Tariff Cuts:

- For U.S. energy, tech, medical, and pharma goods.

- Stronger Origin Control:

- Tighter rules to prevent trade fraud.

- Focus on key exports: wood, seafood, textiles, electronics.

- Developing Industries:

- Attracting investment to reduce import reliance.

- Priority sectors: yarn/fabric, microchips.

Trends & Implications:

- Trade Volatility: Tariffs create uncertainty, requiring agile responses.

- Vietnam’s Strategy:

- Balancing U.S. relations.

- Diversifying its economy.

- Enhancing production.

- Supply Chain Changes: Vietnam aims to be less reliant on imported materials.

- U.S. Importance: U.S. is a major market for Vietnam (e.g., textiles, wood).

- 2024 Trade Data (USTR):

- Total U.S.-Vietnam goods trade: $149.6 billion.

- U.S. exports to Vietnam: $13.1 billion (up 32.9% from 2023).

- U.S. imports from Vietnam: $136.6 billion (up 19.3% from 2023).

- U.S. goods trade deficit with Vietnam: $123.5 billion.

- Key Vietnam Exports to U.S.:

- Computers and electronics

- Textiles and apparel

- Footwear

- Key U.S. Exports to Vietnam:

- Machinery

- Agricultural products

- Aircraft

Retail Optimism vs. Tariff Realities & Shipping Disruptions

Retail Outlook 2025 (NRF):

- Sales Growth: +2.7% to 3.7% YoY (Total: $5.42T–$5.48T).

- Online Sales: +7%–9% YoY ($1.57T–$1.6T).

- Key Factors: Low unemployment, wage gains, solid finances.

- Tariff Impact: Retailers don’t expect tariffs to significantly hurt spending or cause recession.

- GDP Growth: Expected to slow to under 2%.

- Inflation: Tariff-related inflation may keep PCE around 2.5%.

- Risks: Policy uncertainty, lower consumer confidence, tariff anxiety.

- Credit: Delinquencies slightly up but normal if jobs stay strong.

USA/India Tariffs:

- India Export Surge: Bookings to US East Coast (USEC) up due to new 26% US tariff (effective April 9 – NOW PAUSED)

- Rate Hikes: Carriers pushing through April increases. More hikes planned for May (CMA CGM +$1000/container, Hapag-Lloyd +$500/box).

- Logistics: Indian ports working overtime; West India sailings fully booked; logistics delays due to capacity.

- US Importers: Rushing shipments to beat tariff deadline (NOW PAUSED)

- Spot Rates: Rose to $2150/FEU (up 13% on April 7).

Transpacific Shipping:

- Rates Down: Spot rates fallen for 9 straight weeks.

- Capacity Reduction: Carriers like MSC canceling sailings (at least 6 in April). Others expected to follow.

- Disruptions: Vessel changes and delays ongoing, expected through April.

Asia/EU Shipping:

- Ocean Alliance: Resumed AET service (Shanghai to Europe).

- Red Sea Risks: Renewed US airstrikes increase Houthi attack threat on ships, destabilizing region. Many targeted ships have no clear US/UK/Israel ties.