April 14-18, 2025

Airfreight Market Facing Additional Complexities

Heightened Compliance Complexity is the New Normal: Air cargo is facing a surge in complex compliance requirements. This isn’t a temporary blip; it’s driven by increasing security concerns (post-DHL incident) and volatile tariff landscapes (US 301 and 232 duties). The sheer volume of e-commerce is also adding to this complexity.

Data Requirements are Exploding: The jump from 7 to 20 data elements for US-bound shipments is a stark illustration of this. This exponential increase creates a significant administrative burden and a higher risk of delays and errors for shippers.

Tariff Volatility Adds Another Layer of Difficulty: The shift from one tariff number to potentially five for a single product due to new duties underscores the dynamic and often unpredictable nature of international trade. This directly impacts landed costs and requires constant vigilance.

Airlines are Feeling the Pressure and Lack Direct Control: Airlines are often caught in the middle, relying on accurate data from the Beneficial Cargo Owners (BCOs). When customs issues arise, airlines face the challenge of obtaining the correct information, leading to potential delays that impact everyone in the supply chain.

Technology is Seen as a Potential Solution, but Collaboration is Key: While AI, machine learning, and digitalization are mentioned as potential tools to manage compliance, the speakers stress the importance of collaboration among all stakeholders – governments, airlines, and, crucially, the shippers and their forwarders.

Beyond the Tariffs: Why IATA is Bullish on Air Cargo in 2025

Positive Outlook Maintained: IATA remains optimistic about air cargo in 2025, despite emerging tariff concerns.

Limited Tariff Impact: The majority (87%) of global trade is currently unaffected by the latest tariff developments.

New Market Opportunities: Potential redirection of trade flows due to tariffs could create new markets for air cargo.

Significant Freight Volume: IATA forecasts 72.5 million tonnes of freight to be handled by air in 2025.

Short-Term Slowdown Not Alarming: Recent air cargo slowdown is attributed to seasonality and post-holiday activity, with February value drops linked to the shorter month.

Strong CTK Growth Expected: IATA anticipates a 6% growth in global cargo tonne-kilometres (CTKs) in 2025.

Middle East Leading Growth: The Middle East is projected to have the strongest regional CTK growth at 7.5% this year.

Stable Yields Outpacing Inflation: Air cargo yields in 2024 have increased compared to 2019 and have slightly outpaced cumulative inflation (38% yield growth vs. 33% inflation).

Revenue Growth Predicted: IATA forecasts a 5.4% year-on-year growth in air cargo revenue.

Revenue Exceeding Pre-Pandemic Levels: Air cargo revenue has shown growth since 2023, surpassing 2019 figures.

Investment in Sustainability: A portion of the increased revenue will need to be allocated towards achieving net-zero emissions by 2050.

Positive Economic Drivers:

- Strong GDP growth in Asia and developing markets, fueled by sectors like e-commerce.

- Low unemployment levels leading to increased consumer spending and air cargo demand.

- Decreased jet fuel prices (after the 2022 peak), helping to lower operational costs, although price volatility remains a concern.

- Increased globalization driving longer shipment distances and higher cross-regional demand.

Smarter Shipping: Regional Air Cargo Trends Explained

Asia Pacific:

- Rates Softening: General downward trend in air freight rates across the region, varying by origin.

- Demand Concerns: Market anticipates weaker demand, especially in May.

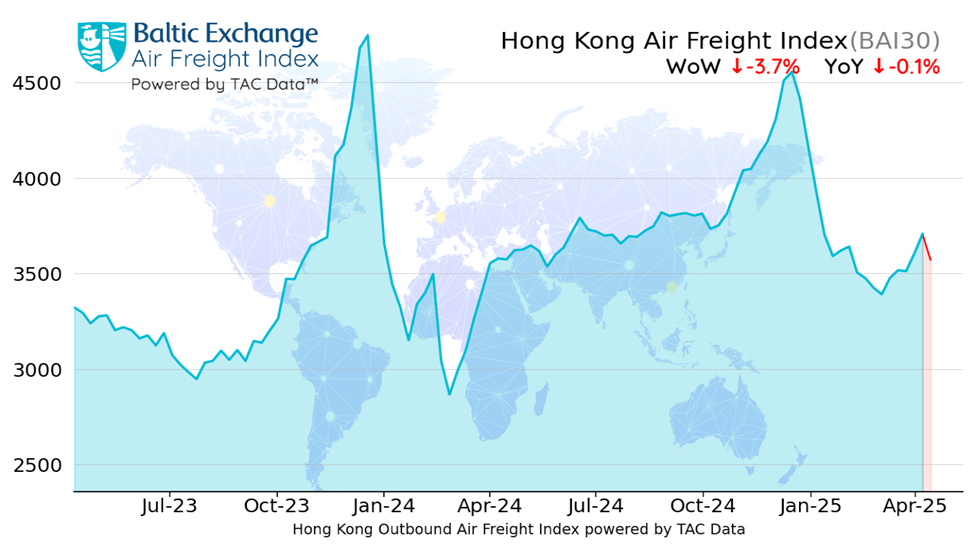

- Hong Kong (BAI30): Significant weekly rate drop (-3.7%), near flat year-on-year (-0.1%), indicating weakening.

- Shanghai (BAI80): Slight weekly rate decrease (-0.6%), but still positive year-on-year (+4.2%), showing some resilience but slowing.

- China (Overall): Mixed rate changes; slight decrease to Europe, slight increase to US.

- Vietnam: Falling rates, suggesting softer demand or more capacity.

- India-Europe: Slight rate increase, indicating stronger demand on this specific lane.

- Tonnage Drop: Early April saw lower tonnages, partly due to Eid and global trade uncertainty.

- Pricing Resilience (Ex-Asia): Despite softer demand, prices increased in early April, suggesting underlying support.

- US Tariffs (April 9): Expected to negatively impact China/HK to US trade.

- Southeast Asia (VN, MY): Increased activity due to sourcing diversification from China, but facing new tariff risks.

- Airport Congestion: Shanghai and Hong Kong experiencing increased congestion.

Europe:

- Firmer Rates: Generally higher rates to US and China, but slightly lower to Japan.

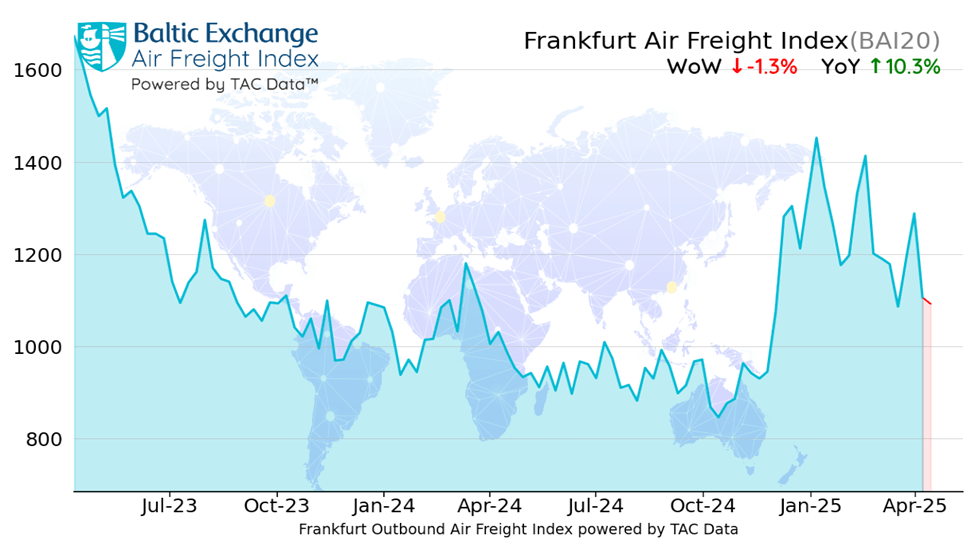

- Frankfurt (BAI20): Weekly dip (-1.3%) due to lower North America rates, but strong year-on-year growth (+10.3%).

- London (BAI40): Continued weekly decline (-3.9%), negative year-on-year (-9.4%), indicating persistent weakness.

- Security Disruptions: New emergency measures impacting Europe-North America cargo.

- Transatlantic Oversupply: Potential for rate cuts or cargo rolling due to excess capacity.

- EU-ETS Expansion: Carbon surcharges extending to intra-Europe and Europe-Asia, potentially affecting pricing.

Americas:

- Rising Rates to China: Strengthening demand for air freight from the Americas to China.

- Chicago (BAI50): Significant weekly (+6.1%) and year-on-year (+18.2%) rate increases, suggesting strong demand/tight capacity.

- US-LatAm Improvement: Market better than 2024 but remains dynamic, with freighter cargo most volatile.

- Transatlantic Capacity Increase: Airlines adding passenger flights, boosting capacity.

- US East Coast Warehouse Demand: Increasing, particularly for food and pharma.

Global Context:

- Global Index (BAI00): Slight weekly decrease (-1.4%), but still up year-on-year (+3.2%).

- Tariff Uncertainty: US tariffs causing significant uncertainty and influencing trade flows (e.g., potential rerouting via Mexico).

- De Minimis Impact: Elimination of threshold for small China packages expected to have an effect.

- E-commerce Weakening: Signs of softer demand on China-US lane, including charter cancellations.

- Tight Freighter Capacity: Aircraft production delays and limited conversions constraining capacity.

- Carrier Capacity Management: Active use of blank sailings.

- Economic Uncertainty: Global economic and geopolitical tensions contributing to market volatility.

Airfreight Rates – Asia to USA, EU, and Mexico

April 14-20, 2025

| Origin | EU | US | Mexico | ||

| HKG | USD5.00-6.00 | USD4.60 – 7.00 | USD6.30-7.60 | ||

| CAN | USD4.00-5.00 | USD4.50-6.00 | USD5.80-7.00 | ||

| CGO | USD4.00-5.00 | USD5.25-6.00 | USD9.00-10.00 | ||

| PEK | USD4.00-5.00 | USD5.25-6.00 | USD9.00-10.00 | ||

| PVG | USD4.40-5.00 | USD5.00-5.60 | USD5.90 | ||

| SZX | USD4.30-5.30 | USD4.30-6.00 | USD5.80-7.00 | ||

| XMN | USD4.50-5.50 | USD4.50-5.50 | USD5.50-6.20 | ||

| SIN | USD5.00-6.75 | USD7.50-9.50 | USD9.75-11.75 |

| SGN | USD 4.00 (+500kg & +1000kg) | LAX: USD 4.75 JFK: USD 5.25 (+500kg & +1000kg) | USD 6.05 (+500kg & +1000kg) | ||

| HAN | USD3.30 (+500kgs & +1000kgs) | West Coast: USD6.30-6.40 East Coast: USD6.80-7.00 | USD6.50 (+500kgs & +1000kgs) | ||

| BKK | USD3.50-4.50 | USD6.00-8.00 | USD9.50-10.25 | ||

| CGK | USD3.00-3.50 | USD4.50-5.50 | USD6.00-7.00 | ||

| PEN | USD3.50-4.00 | USD5.00-6.00 | USD7.50-8.50 | ||

| KUL | USD3.50-4.00 | USD5.00-6.00 | USD7.50-8.50 | ||

| ICN | USD7.00-7.90 | USD7.85-9.85 | USD8.50-10.50 | ||

| TPE | USD4.75-7.20 | USD5.00-8.25 | USD6.35-8.35 |

The above data is market based – for immediate spot rates email matthew.fotion@arcglobal.us. I look forward to saving you time and money.