Week 4 update

International Art Shipping – Uncertainty Affecting Purchase Trends

I’ve spoken to many gallerists, registrars, and directors over the last few weeks who are expressing major concerns of waning interest and lack of purchases. When I ask what markets are being targeted and or avoided, the general response is that a collective decision was made to halt shipments due to tariff confusion.

This is the exact moment a Gallery should pick up the phone and call someone like myself. Licensed NVOCC’s like ARC Global have incredible resources to assist in HTS classification, duty outlay, etc.

A Gallery is the most valuable, the most passionate, element to the Fine Art ecosystem. A Gallery assists in the shared discovery of meaning between Creator and Consumer.

90-Day Pause Creates Uncertainty: The pause on US & reciprocal EU tariffs, intended for trade negotiations, is causing confusion and hesitation among art collectors, dealers, and auction houses.

Market Hesitation: Buyers and sellers are reluctant to commit to transactions, fearing potential tariff reimposition or hoping for complete elimination. This is impacting upcoming auctions and art fairs.

Legal Confusion: Lawyers are struggling to provide clear guidance, as the definition of “artworks” under the Harmonized Tariff Schedule remains ambiguous.

Impact on International Trade: The tariffs and retaliatory measures are disrupting cross-border art trade, with examples from Canada and Mexico.

Shipping and Logistics Challenges: The uncertainty surrounding tariffs is creating challenges for fine art shippers, who need clarity on classification and potential costs.

In today’s volatile international trade landscape, particularly with the uncertainty surrounding tariffs on art and antiques, galleries face increased complexity and potential financial risks when shipping valuable pieces. Navigating these challenges demands expert logistics management. A skilled Non-Vessel Operating Common Carrier (NVOCC) like ARC Global acts as a vital partner in mitigating these risks by ensuring meticulous documentation and strict compliance with complex customs requirements. The ambiguity in classifying “artworks” further underscores the necessity of precise cargo classification to avoid unforeseen tariff charges.

Moreover, the market hesitation caused by tariff concerns can lead to shipment delays, highlighting the need for flexible and adaptable logistics solutions. ARC Global actively monitors global trade negotiations and their regional impacts, providing galleries with proactive insights. By entrusting their shipping needs to a licensed NVOCC like ARC Global, galleries gain a strategic advantage, ensuring secure, cost-effective, and compliant transportation of their valuable collections amidst an ever-changing international trade environment.

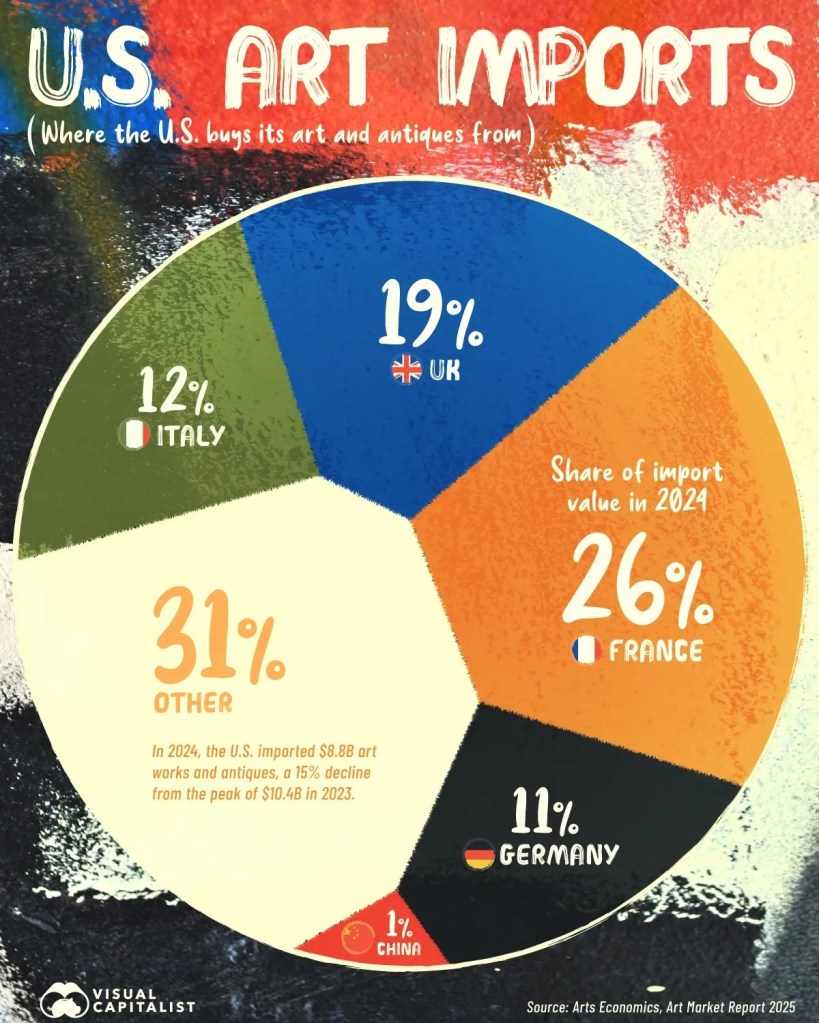

Where The US Imports Fine Art From, An Infographic

A simplified infographic on where US collectors and galleries are importing Works from. I’d say this is fairly accurate – what are your thoughts?

OOCL Expands Far East Reach with Large Ship Order

OOCL Fleet Expansion: Orient Overseas Container Line (OOCL) is investing over $3 billion to build 14 new container ships in China.

Significant Capacity Increase: These vessels, each with a capacity of 18,500 TEUs (twenty-foot equivalent units), will significantly boost OOCL’s fleet capacity.

Methanol Dual-Fuel Technology: Notably, these new ships will be equipped with methanol dual-fuel engines, indicating a move towards potentially greener shipping options in the future.

Construction and Timeline: The ships will be built by Dalian COSCO KHI Ship Engineering (DACKS) and Nantong COSCO KHI Ship Engineering (NACKS), with deliveries expected between 2028 and late 2029.

Impact on COSCO Group: This order increases the COSCO Group’s total order book to 64 ships with a combined capacity of 1.11 million TEUs, positioning them as the third-largest globally in terms of order book size, behind MSC and CMA CGM.

Strategic Alignment: OOCL states this investment supports their long-term strategy for fleet capacity growth and balanced expansion.

More Future Ship Space: OOCL’s big new ship order means more potential capacity for your specialized freight down the line.

Greener Shipping Potential: New ships use cleaner methanol fuel, aligning with sustainability goals.

Long-Term Carrier Stability: OOCL’s investment shows they’re in it for the long haul, offering reliable service.

Stronger Network Access: As part of COSCO, a bigger fleet means a more extensive global shipping network.

Early Market Trend Insight: This order gives a heads-up on future shipping capacity and potential rate shifts.

ARC Global’s direct office network covers the Far East easily – take a look below at geographical coverage:

DHL Outlook for 2025 Airfreight – Tighter Space

DHL Expects Q4 Air Cargo Peak: Despite global trade uncertainties, DHL anticipates the traditional surge in air cargo demand during the fourth quarter of 2025.

Competitive Market Concerns: DHL acknowledges a highly competitive and somewhat uncertain airfreight market currently.

Slight Volume Decrease, Revenue Increase: DHL’s airfreight volumes decreased by 3% year-on-year in Q1 2025, but revenue in their Global Forwarding, Freight (GFF) division increased by 4%.

Mixed Performance Compared to Competitors: While DHL saw a volume decrease, Kuehne+Nagel reported an increase, and DSV’s demand was flat, indicating varying market experiences among major players.

Tariff Disruption Mitigation: DHL states their diverse shipment distribution has shielded them somewhat from tariff disruptions. The B2C Pause into US markets has ended as of 2-MAY-25.

Increased Weekly Volume Volatility: Since early April 2025, DHL has observed a rise in the unpredictability of weekly cargo volumes across different trade lanes.

Long-Term Trade Growth Prediction: Despite current challenges, DHL’s Trade Atlas 2025 report forecasts continued global trade growth in the coming years.

Q4 Capacity Alert: Expect tighter air cargo space and higher prices in late 2025; plan ahead for critical shipments.

Negotiation Opportunity: Competitive air market may allow for better rates, especially outside peak season.

Value of Reliable Carriers: DHL’s focus on revenue over volume signals quality service for sensitive cargo.

Tariff Stability: DHL’s diverse network offers more predictable international shipping costs.

Expert Handling Needed: Increased market volatility underscores the importance of skilled logistics management.

Long-Term Air Cargo Viability: DHL’s growth forecast assures continued investment in air transport.

For shippers and importers reliant upon DHL or other parcel carriers – expect more volatility. Flat out, customers of ‘the big three’ (UPS, FDX, DHL) get bounced around like a ping pong ball every time an executive decides to enact a GRI (general rate increase).

It’s not fair.

It’s not fair because there are options at your disposal, one that is an ‘open-ecosystem’ allowing for choice of equipment, terminal, carrier, etc. That’s where a licensed NVOCC comes in. You won’t be told by your freight forwarder “hey sorry, we as a company decided we aren’t going to move these shipments anymore” or “our apologies, our equipment spread in LAX isn’t mixed enough and we don’t have an available flight for your shipment.”

Using my services with ARC Global will open doors to you like ATA Carnet development, duty outlay, HTS classification, affordable handling costs, origin-based rates out of Asia, you name it.

Thank you for reading, I’m thrilled to be your logistics resource as we continue on in 2025. When you’re ready for exceptional service, we can create an action plan together on how to keep more money in your pocket.

Matthew

matthew.fotion@arcglobal.us