Primary focus on Southeast Asia this week, including trade negotiations and ship building, along with excellent data sets on current aggregate airfreight figures to and from EU / APAC

Thank you for reading. My goal is to bolster your knowledge of key trade factors at play that are either hurting or helping your current supply chain. The included information this week (Week 27) highlights the changes to APAC-USA trade and what businesses should be mindful of as they procure space for trade.

ARC Global Logistics, the NVOCC I work for, was founded in Asia and boasts almost two-dozen direct offices throughout the region. When we include our Tijuana office in Mexico, two offices in the US, and agency network in the EU, we’re truly unstoppable.

Let me help you create a rock-solid RFQ that takes your needs into account, while giving you incredible service and ratability.

Matthew

Indonesia Eases Import Restrictions Ahead of US Tariff Talks

President Prabowo Subianto is looking to make Indonesia economically appealing to the Trump administration prior to the July 9th tariff deadline.

Easing Restrictions: Restrictions will be eased on ten groups of commodities over the next two months.

Joint Investment Offer: Indonesia has offered the U.S. joint investment in a critical minerals project, focusing on nickel, copper, and other minerals vital for the “electric vehicle ecosystem.”

Direct Engagement: Indonesian officials, including Coordinating Minister for Economic Affairs Airlangga Hartarto, have been in direct talks with U.S. Treasury Secretary Scott Bessent, with some offers agreed to in principle.

Products to Benefit: Plastic and chemical products, fertilizer, and forestry items were highlighted as examples that will become easier to import into Indonesia.

Trade Imbalance: Indonesia is Southeast Asia’s largest economy and holds a significant trade surplus with the U.S. ($16.8 billion last year), largely due to its protectionist trade policies.

Oil and Gas Offer: In April, Indonesia offered to buy an additional $10 billion in American crude oil and gas to help balance the trade surplus.

Tariff Context: The U.S. had imposed a 32 percent tariff on Indonesian goods, which was paused until July 9 for negotiations.

Potential Ripples in the US Economy:

Increased Export Opportunities: The easing of import restrictions by Indonesia presents a clear opportunity for U.S. exporters. This could lead to a modest boost in U.S. export volumes, particularly for the specific commodities mentioned.

Strategic Mineral Supply Chain Security: The offer for joint investment in critical minerals (nickel, copper) is strategically vital. For the U.S., securing diversified and stable access to these minerals is paramount for the rapidly expanding electric vehicle (EV) industry and broader renewable energy sector. This could reduce reliance on other less stable or competitive sources.

Energy Sector Growth: Indonesia’s commitment to purchase an additional $10 billion in U.S. crude oil and gas would provide a substantial boost to the U.S. energy sector, supporting jobs and production, especially in regions with significant oil and gas reserves.

Trade Balance Adjustment (Minor): While Indonesia’s trade surplus with the U.S. is substantial, these measures could slightly narrow the gap. Increased U.S. exports and energy sales would contribute to a more balanced trade relationship over time.

Precedent for Future Negotiations: A successful outcome here could set a positive precedent for the U.S. in negotiating with other countries that maintain protectionist policies, demonstrating that a collaborative approach can yield mutual benefits.

Top commodities to be affected beneficially include copper, nickel, forestry items, oil & gas, fertilizer and chemical products.

MSC’s Megamax Expansion in China: A Shipping Giant’s Strategy

Further solidifying China’s dominance in the commercial shipbuilding industry, MSC is actively increasing its “Megamax” using Chinese building firms.

Massive Order: MSC has ordered up to six new 22,000 TEU (twenty-foot equivalent unit) LNG dual-fuel newbuilds from China Merchants Heavy Industries’ Haimen shipyard.

Significant Investment: Each ship is estimated at over $200 million, with deliveries starting in 2027.

China’s Growing Role: This order marks China Merchants Heavy Industries’ debut in the large boxship construction segment, further showcasing China’s increasing capabilities in ultra-large vessel construction.

MSC’s Dominance: MSC already controls about 20% of the global operated fleet and has a massive orderbook of over 120 ships, adding more than 2 million TEU in the coming years. Their backlog of 19,000-24,000 TEU ships will now exceed 60.

Previous Orders: Earlier this year, MSC also placed orders for similar LNG dual-fuel megamax containerships with other Chinese shipyards (Zhoushan Changhong International Shipyard and Hengli Heavy Industry) for deliveries in 2028 and 2029.

In short, while there may be an easing of import costs associated with this beefed up fleet (once operational), there is a continued and significant reliance placed upon China and its shipbuilding prowess.

That reliance will only be further strained if and when China decides to place greater restrictions upon prospective buyers, US interests, etc.

Air Cargo Updates: What Small – Medium Businesses Need To Know

Rates Settling: Global airfreight rates are down slightly (0.6% last week, 5.3% year-over-year).

Transpacific Shift: Despite fewer cargo planes on China-to-US routes, rates haven’t plunged. In fact, some China-to-US rates even rose last week. This is partly due to a recent 90-day tariff deal between the US and China, which has led to a rush of bookings.

E-commerce Hit: A big reason for the shift: The U.S. removed the “de minimis” exemption for Chinese e-commerce packages (under $800 value). These now face a 30% tariff, hitting online sales from China hard and causing a drop in related air cargo volumes. This specifically affects cheap, low-value goods often sold directly to consumers.

Southeast Asia Rises: As China’s e-commerce air cargo shrinks, demand from Southeast Asia (especially Thailand and Vietnam) is picking up. This is driven by companies shifting production to avoid China tariffs, leading to tighter capacity and higher rates on those lanes.

Effects felt from US Businesses:

Higher Import Costs (Especially for E-commerce):

- Direct Hit for Low-Value Goods: The removal of the “de minimis” exemption means U.S. consumers and businesses buying any product under $800 directly from China now face additional tariffs (up to 30% or more, depending on existing duties, totaling up to 145% in some cases) and potentially increased shipping costs. This directly impacts SMBs that dropship or source low-cost items from China for resale.

- Price Hikes & Less Choice: Consumers will see higher prices for many common imported goods, and some very low-cost items might disappear from the market as they become unprofitable to import. This can shift consumer behavior.

- SMBs Absorb Costs or Raise Prices: Small online retailers relying on this model must now either absorb these new costs, raise their prices (making them less competitive), or find new sourcing strategies outside China. Many may struggle to adapt.

Supply Chain Diversification Accelerates:

- The shift in air cargo demand to Southeast Asia signals an ongoing trend for U.S. SMBs to diversify their sourcing away from China. This could mean more complex logistics for SMBs but potentially more resilient supply chains in the long run.

- Opportunity for “Nearshoring”: The increased cost and complexity of importing from Asia might push some SMBs to consider sourcing from closer regions (like Mexico or even re-shoring to the U.S.), though this comes with its own cost considerations.

Increased Shipping Volatility & Delays:

- Middle East Impact: Even if your goods aren’t coming directly from the Middle East, diversions there affect global air cargo capacity and fuel costs. This can lead to overall higher airfreight rates and less reliable delivery times for any long-haul air shipments impacting U.S. businesses.

- Unpredictable Rates: While global rates are “modest,” the underlying market is still reacting to tariff changes and geopolitical events. SMBs need to stay agile and monitor airfreight costs closely.

Shift in Fulfillment Models:

- Many large Chinese e-commerce players (like Temu and Shein) are reportedly shifting from direct air parcel shipping to using U.S. warehouses and ocean freight for bulk imports to avoid the new tariffs. This could free up some transpacific air cargo capacity long-term, but it might not translate to lower prices for SMBs using air cargo for B2B needs. SMBs might also consider similar strategies if their volume allows.

Additional Check-Up: What’s Happening in Airfreight and How It Affects Business

China-US Cargo Down: Air freight from Asia to North America dropped significantly (10.7%) in May. Why? New U.S. tariffs and the end of the “de minimis” rule for small Chinese packages.

Other Routes Booming: Trade routes from Asia to Europe, within Asia, and between North America and Europe are seeing strong growth, picking up the slack.

New Tariff Reality: Small packages from China (like e-commerce orders) now face 30% to 145% tariffs in the U.S., making many low-cost items much more expensive.

Manufacturing Slowdown: Global manufacturing is shrinking, hinting at overall weaker trade demand.

Effects felt on US Businesses:

- Higher Import Costs: If your business (or your customers) buys low-value goods from China, expect significantly higher prices due to the new tariffs. Some items might even disappear from the market.

- Supply Chain Shift: Companies are increasingly moving sourcing away from China towards places like Southeast Asia. This means more complex logistics but potentially stronger supply chains long-term.

- Logistics Headaches: More tariffs mean more paperwork and potential delays at customs, adding cost and complexity for SMBs.

- Market Rebalancing: Airlines are adapting by moving planes to busier routes. While overall air cargo might stabilize, specific lane rates remain volatile.

The era of cheap, tariff-free imports from China and others in APAC is largely over.

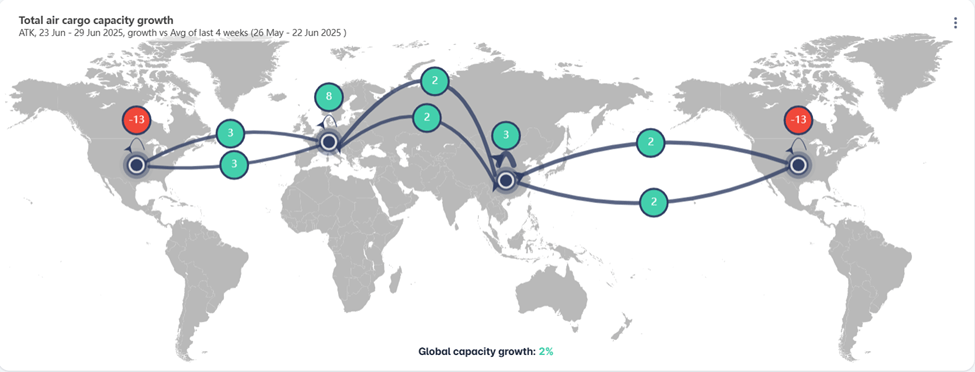

Let’s Rotate: Powerful Airfreight Data on Tonnages, ATK, and Frequency

NA Outbound:

While intra-NA routes are taking a beating (possibly East Coast to Midwest and Anchorage to West Coast. Think E-Commerce), growth to Europe and Asia grew very modestly at 2% and 1% respectively.

Flights from Asia to US Stable: The number of flights coming from Asia to the U.S. is flat (0%).

Flights from Europe to US Up: The number of flights from Europe to the U.S. increased by +2%.

Other Key Routes: Intra-Asia flights saw 1% growth, and Europe to Asia flights increased by 1%.

If you’re shipping out of the U.S. to Asia or Europe, prepare for fewer flight choices and potential delays. For imports, Europe looks better, while Asia routes show stable flight numbers despite some capacity gains.

Asia to US Capacity Up Slightly: Capacity from Asia to the U.S. saw a modest increase of +2%.

Other Key Routes: Growth was also seen from Europe to Asia (+2%), within Asia (+3%), and from the Middle East to Europe (+3%).

Let’s get to work together on tackling current supply chain challenges. I’m fortunate to hold many keys to many more doors, and I want to open them for you.

Matthew