Week 29 Review – TC1 / TC2 air rates, Chinese shipbuilding updates, Cathay Cargo June numbers, Mexico / US air dispute, and Xeneta recap on the Eastbound TP Lane

Chinese Shipbuilding – Where Do We Stand?

China’s shipbuilding orders are down in the first half of 2025.

Their market share for new contracts fell from 72% to 52%.

The main reason? Upcoming US Trade Representative (USTR) port fees targeting Chinese ships and shipbuilders.

These fees start in October 2025 and will increase over time.

- Chinese-built ships: $18/ton this year, up to $33/ton by 2028.

- Container ships: up to $250/container by 2028.

- Chinese operators: $50/ton from day one.

Shipowners are worried about these extra costs.

New orders at Chinese yards dropped 68% year-on-year.

South Korea’s orders only fell 7%, and their market share grew significantly.

Most ship types saw a drop in new contracts, except for containers and cruise ships.

However, South Korea and Japan have limits on how much more they can build due to:

- Already full shipyard schedules (orders stretch into 2027-2028 and beyond).

- Aging workers, labor shortages, and rising wages.

China still leads in most shipbuilding sectors, but South Korea has surpassed them in crude tanker orders this year.

MSC Adds Massive New Capacity Builds – Shipbuilding Continued:

MSC’s HUGE Ship Orders:

- Buying Binge: MSC is adding 10 more super-sized container ships.

- Massive Fleet: They now have more new ships on order than some entire shipping companies currently have!

- Greener Ships: Many are built to use cleaner fuel like LNG.

- Coming Soon: These new giants will start sailing in 2028-2029.

- More Space: This means a lot more space for cargo on the oceans!

Quick Look:

- New Ships: 10 more huge ones.

- Arrive: 2028-2029

- Total New Capacity: Enough to fill 2.2 MILLION standard containers!

Why This Matters & How We Help (Your NVOCC Partner in Asia/North America):

More ships can be good, but it also means changes. Our job is to make sure your shipping is always smooth and affordable.

- More Options, Better Prices: We work with all the major shipping lines. More ships generally mean more options and potentially better rates for your cargo. ARC finds the best deals from a net-origin basis.

- Always Room for Your Freight: Even with lots of new ships, things can get crazy. We have strong connections to make sure your goods always find a spot.

- Smooth Sailing: Our teams in Asia and North America handle all the details, from pickup to delivery. No headaches for you!

- Smart Decisions: We watch these big shipping trends to give you the best advice on how to move your goods (full containers or smaller shipments) to save you time and money.

Cathay Cargo Beats Out June Gloom – The Numbers:

Cathay Cargo’s June Performance:

- Good Growth: Cathay’s cargo business saw good growth in June.

- More Weight: They moved over 130,000 tonnes of cargo in June. That’s up 6.3% from last year!

- More Space, Slightly Less Full: They offered 5% more cargo space (AFTKs), but planes were slightly less full (load factor down 1.1%).

- Overall Strong Half: For the first six months of 2025, their total cargo weight was up 11.3% compared to last year.

Why the Boost? (It’s About Tariffs!):

- Tariff Rush: A big reason for the June bump was companies rushing shipments because of tariff changes (like a temporary pause in US-China duties).

- Key Lanes: They saw strong demand from Southeast Asia and Taiwan to the Americas, especially for electronics and high-tech goods. Medicine shipments also did well.

- Uncertain Future: They expect demand to remain unpredictable in July.

The Bigger Market Picture:

- US-China Tariffs: The US and China currently have a 90-day agreement (until August 11) for a 10% duty on Chinese imports. This temporary break can cause spikes in shipping.

- Actual China-US Drop: Even with Cathay’s June boost, overall cargo volumes from China to the US actually dropped 20% in April-May (compared to last year), showing the impact of tariff uncertainty.

What This Means For Your Shipments (Asia to North America):

- Market Swings: You can expect sudden rushes or slowdowns based on trade policy, especially with tariffs.

- Regional Differences: Demand isn’t uniform. Southeast Asia and Taiwan might be busier than mainland China at times.

- Capacity Watch: Airlines are adjusting space, but demand can still be tricky to predict.

How We Help:

- We watch these market shifts daily.

- We help you understand how tariffs and demand changes might affect your shipping plans.

- We connect you with the best options from all parts of Asia to get your cargo to North America efficiently.

Week-Over-Week Performance from Asia – Airfreight Continued:

TC1/TC2 Rates from Week 29:

Compare with last week

– Rate ex CAN/SZX to EU reduce 2-17%

– Rate ex PVG to EU increase 5% and to Mexico increase 14%

– Rate ex XMN to EU decrease 4-5% but to Mexico increase 3-5%

– Rate ex SGN to US decrease 2-3%

– Others remain unchanged

Mexico & USA Air Freight Tiff – What Happened?

- Fight Over Flights: The U.S. says Mexico broke a deal, making it harder for American airlines (like FedEx, UPS, Delta) to use Mexico City’s main airport.

- Forced Moves: Some flights were pushed to a different airport, causing delays and extra costs.

- U.S. Is Mad: The U.S. government is threatening action, which could mess up more flights and even a big airline partnership (Delta/Aeromexico).

- Your Impact: This means potential delays and higher costs for your goods moving by air between these two countries.

Why Your NVOCC Partner Matters (Especially with Offices in Mexico, US, & Asia)

When things get tricky, you need a smart partner. Here’s how we help:

- We Know the Rules: Our local teams understand changing laws in Mexico, the U.S., and Asia, keeping your cargo compliant.

- No Surprises: We spot potential problems early and find new ways to ship your goods, avoiding delays.

- Best Routes, Best Prices: We find the smartest, most cost-effective ways to get your cargo moving across all regions.

- Smooth Sailing: Our global network means your shipments glide smoothly from one country to the next.

- Always in the Loop: You’ll always know where your cargo is, no matter where it’s headed.

- Less Risk: We spread your risk by having many options, so one problem won’t shut down your whole supply chain.

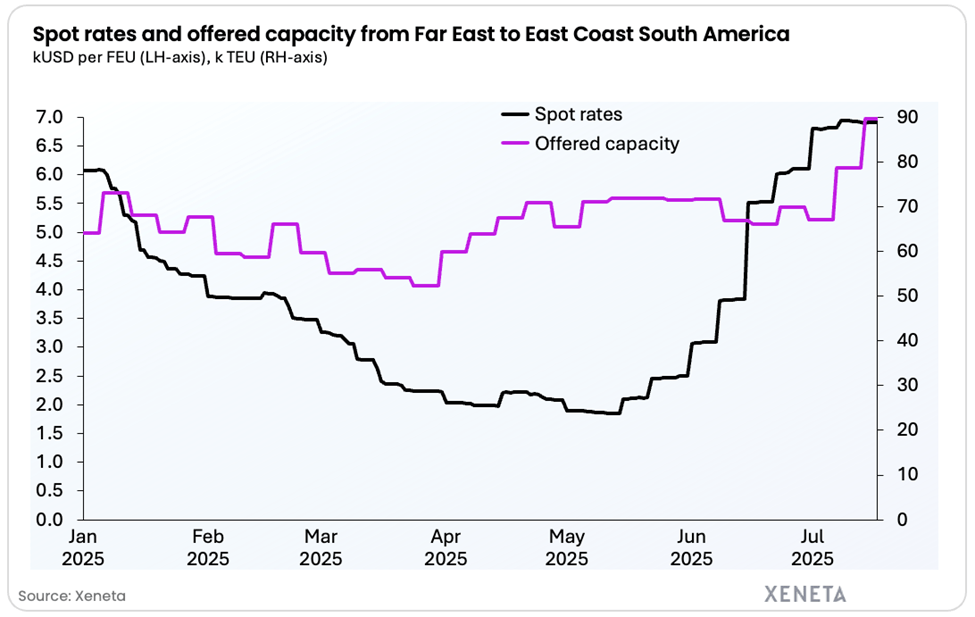

Xeneta Update on Eastbound TP Lane – Data-Driven Facts:

. The US-China “Tariff Rollercoaster”:

- April: Tariffs hit, demand for shipping from China to the US “fell off a cliff.” Ships moved to other routes (like Europe, South America).

- May/June (The Rush!): Tariffs were lowered for 90 days (until mid-August!). Companies rushed goods into the US.

- Rates Jumped: West Coast rates shot up 75% in a day, East Coast 58%!

- Now (Rates Crashing): Too many ships rushed back to the US routes. Now there’s too much space.

- Rates Plummeted: West Coast rates are down 58%, East Coast 35% since late June!

2. Uneven Impact: West Coast vs. East Coast:

- West Coast Faster: Ships could get to the US West Coast faster after the tariff pause. So, rates there dropped quicker.

- Rate Difference: Normally, East Coast shipping costs about $1000 more per container than West Coast. But right now, the difference is much bigger (over $2000!). This is because West Coast rates fell harder.

3. “Ripple Effects” Across the Globe:

- South America: When ships left China-US routes in April, rates to places like South America shot up over 260%! Now, as US rates fall, carriers are sending ships back to South America, which should bring those high rates down.

- North Europe: Rates to North Europe also jumped 78% since late May. This is partly due to port traffic jams there (strikes, low water) but also because some ships taken off the US routes ended up in Europe.

What This Means For You (Key Takeaways):

- Extreme Volatility: Tariffs create huge, fast swings in shipping prices and available space.

- Global Impact: A tariff change in one region affects rates and ship availability worldwide.

- Different Routes, Different Stories: West Coast, East Coast, South America, Europe – each trade lane reacts differently.

- Downward Trend (Mostly): For US and South America routes, rates are likely heading down for the rest of 2025.

- Europe’s Different: Port issues in North Europe mean rates there might stay higher longer.

In Short: The market is wild. Predicting costs is super hard right now. You need to understand these global shifts because what happens far away can directly impact your shipping costs and delivery times from Asia to North America.