Airfreight data and where we’ll see the greatest returns for US-based businesses

Airfreight Market Struggles Continue Through Year-End

The airfreight market is facing a challenging second half of the year, with ongoing struggles expected to last through Q4. Here’s a quick summary of what’s happening and why:

Key Takeaways from the DHL Q2 Report

- Revenues are down despite volumes being up. DHL saw a slight increase in airfreight volumes, but revenue fell due to negative currency effects and a tough trade environment.

- The focus is on cost control. The company is tightening its belt and cutting costs to protect profits amidst the market volatility.

- Continued volatility is expected. DHL’s CFO predicts a choppy market for the rest of the year, with slower airfreight volume momentum.

Broader Market Analysis: Corroborating the Struggles

Multiple sources across the industry agree with DHL’s outlook. The reasons for the continued struggle are clear:

- Slowing Demand: After a strong start to the year, demand for air cargo is showing signs of cooling. This is likely due to economic headwinds and more cautious consumer spending.

- Capacity vs. Demand: Airlines are adding more cargo capacity, especially as passenger flights return. This oversupply, combined with slowing demand, is putting pressure on freight rates.

- Trade Uncertainty: New tariff deadlines and ongoing geopolitical tensions are making it hard for businesses to plan. This uncertainty often leads to a slowdown in shipping as companies adopt a “wait and see” approach.

- Lean Inventories: While some companies have lean inventories, which could spark a restocking rush, if consumer demand softens, they’ll simply slow down orders, leading to weaker freight volumes.

In short, a mix of economic uncertainty, geopolitical issues, and an oversupply of capacity will likely keep the airfreight market challenging for the remainder of the year.

What Current Airfreight Data Means for US Importers and US Exporters

For US Importers

Right now, the US market is a bit of a guessing game. Many companies have been importing goods early to get ahead of potential tariff increases. This created a rush that boosted demand.

- Weak Demand Scenario: If the US economy slows down, all this early inventory will mean companies have enough stock. This will cause demand to drop significantly, leading to lower freight rates as carriers compete for your business.

- Strong Demand Scenario: On the flip side, if US consumer spending picks up, companies will burn through that stock quickly. This would trigger a sudden rush to restock, creating a capacity crunch and driving freight rates up dramatically for those needing to move goods fast.

Ultimately, your rates will depend on which of these two scenarios plays out.

For US Exporters

The impact on exporters is less about inventory and more about global economic health. While the US market is uncertain, the article notes that global uncertainty is affecting GDP growth worldwide.

- Mixed Global Demand: Some areas, like Latin America, are still showing strong demand. This creates pockets of opportunity. However, overall global economic slowdowns will likely temper demand for US goods.

- Impact on Rates: The general uncertainty will likely lead to more volatile rates. When global demand for US exports is weak, rates will fall. But if a specific region sees a spike in demand, rates on those particular trade lanes will likely rise.

Jet Fuel Prices, De Minimis, and An Aging Freighter Fleet – Your Impact

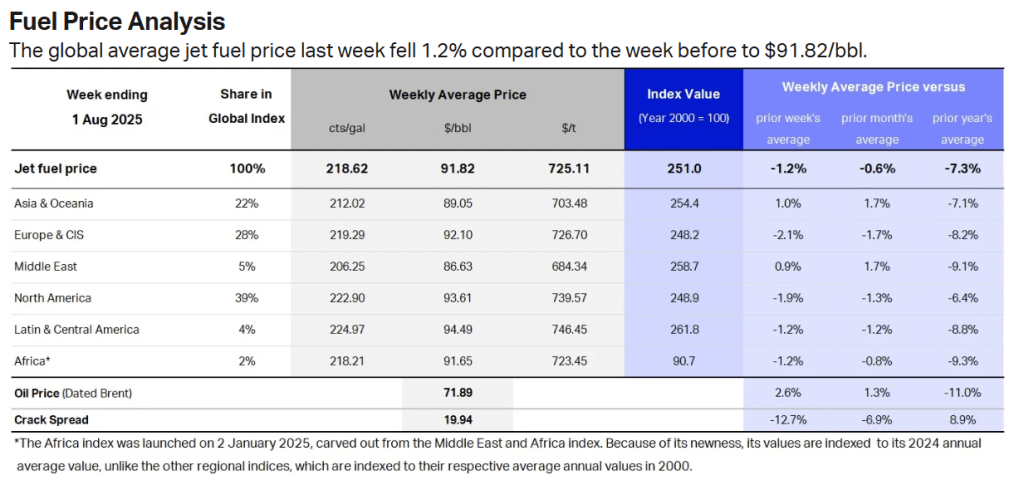

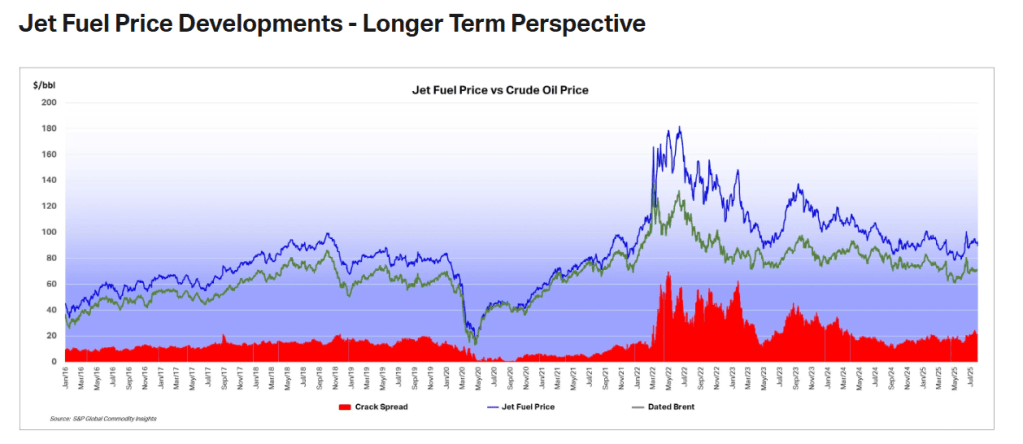

With current global jet fuel prices hovering around $92/bbl, we’re almost half the cost of where we peaked in ’22 thanks to Covid and the E-Comm boom.

The current global cargo fleet is comprised of widebody and narrowbody converted freighters that is averaging 30-35 years of age per unit. A 30 year old 747-400F for example, loses almost 25% of fuel efficiency compared to current generation models.

We see volume waning in major trade lanes and carriers like DHL looking to minimize exposure through capacity reduction. Even if jet fuel prices remain steady, a lowered volume outlook for Q3-Q4 will push carriers to streamline further.

And De Minimis?

Because E-Comm was quite literally keeping this aging fleet in the sky, carriers didn’t mind using 30-35 year old units knowing further capacity won’t come on line until 2027. Now that De Minimis in the US has changed, the efficacy of using these craft to haul freight in the Eastbound TP Lane has become dubious.

Our Recommendation for an Edge

- Monitor ATK changes on a WoW basis

- Carriers will adjust capacity in certain lanes to account for fuel costs and demand changes

- Renegotiate Contracts for Spots

- If your contract agreement is higher than falling spot rates, look to renegotiate through additional volume for your NVOCC

- Look to offer consolidation – NVOCC’s will be willing to negotiate if you can add volume per shipment

- Utilize Networks with Origin Offices

- Forwarders like ARC Global Logistics who have offices in origin countries, can access better, faster rates than US counterparts